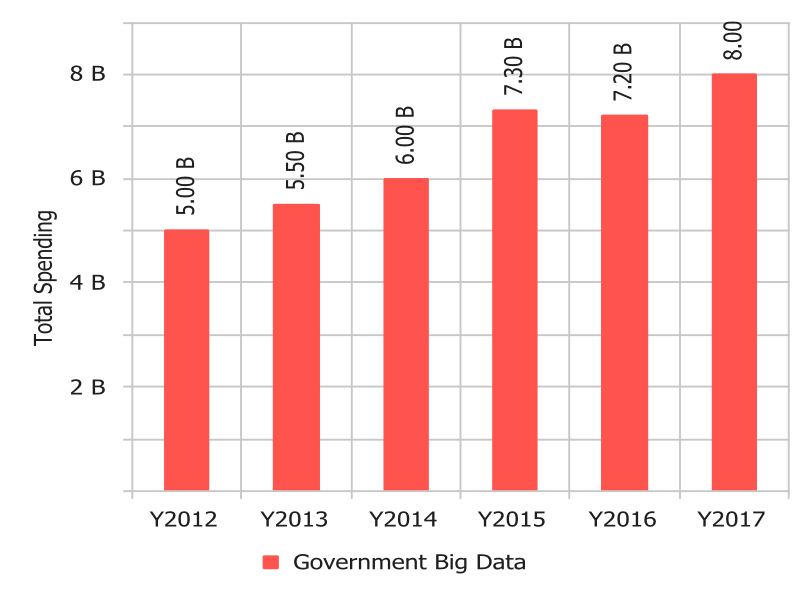

The financial services industry has long been a central user of big data – from banks, to credit card companies, to insurance and others. As an industry that heavily relies on the information and insights that can be gleaned from big data, they actively invest in getting more, buying and collecting it along different points of the customer journey. In an ideal world, organizations would make good use of this data, to grow their operations and gain a better understanding of their customers.

For reasons ranging from technology limitations, to a lack of expertise, manpower and resources, the reality, however, is frequently very different. Data professionals in the industry are faced a challenge: as they watch their data stores grow, more and more of this potentially valuable business information remains stuck in lakes, silos and other less accessible locations. Organizations are losing out the data they already own and missing out on potentially valuable business insights.

SQream’s newest e-book, Best Practices in Data Management for the Financial Services Data Professional, was created especially for data professionals faced with this situation. It lays out a clear list of action items data professionals can follow to quickly ingest, organize, analyze and manage their big data. “This is an issue that is prominent in many industries, but we see it is especially relevant in the banking and financial services world,” said SQream co-founder and CEO Ami Gal. “These organizations own massive amounts of information that they cannot rapidly and efficiently access and analyze.”

One frequently cited statistic says that although 90% of global data was created in the last 5-years, only one percent of this data has ever been analyzed. The data stores of financial services organizations are holding a goldmine of potential BI, SQream wants to help them take advantage.

The e-book can be downloaded here.